Mortgage rates are hovering around 6.3–6.4% for 30-year fixed loans in October 2025, while housing inventory is rising and price growth is slowing, creating more opportunities for buyers.

Here’s a detailed snapshot of the current real estate and mortgage market landscape:

🏠 Real Estate Market Trends – October 2025

Home prices have plateaued: After years of rapid growth, price increases have slowed to their lowest levels since mid-2023. Bidding wars are rare, and list prices are mostly flat.

Inventory is rising: Especially in the South and West, housing supply has returned to pre-pandemic levels, giving buyers more options and reducing competition.

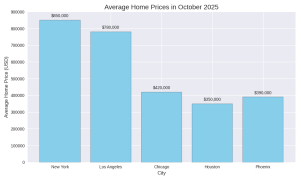

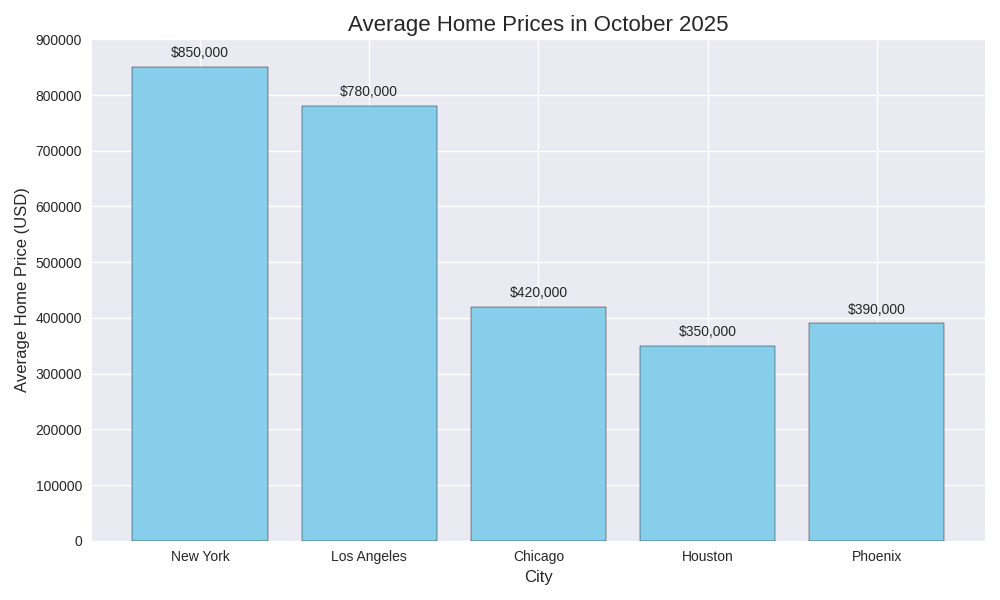

Regional disparities:

South & West: Inventory up 4.3% and 9.3% above pre-pandemic levels.

Midwest & Northeast: Still facing shortages, with inventory down 40% and 51.1% respectively.

Equity gains for long-term homeowners: Many owners have seen their home values triple since 2000, creating substantial wealth and potential for strategic selling.

💰 Mortgage Market Update – October 2025

Current rates:

30-year fixed mortgage: ~6.34%–6.44%

15-year fixed mortgage: ~5.4%–5.72%

Refinance rates: Slightly higher than purchase rates; 30-year refi averages 6.46%

Federal Reserve influence:

A rate cut in September (0.25%) was already priced into mortgage rates.

Another cut is expected in late October, which could lead to further rate declines—but may already be anticipated by markets.

Economic indicators:

Labor market weakening: Private sector lost 32,000 jobs in September, which may pressure rates downward.

Inflation concerns: Still present, but moderating, which could support lower rates over time.

📈 Forecasts and Buyer Outlook

Rates likely to trend downward: Experts predict rates may end 2025 between 5.7% and 6.4%, but staying above 6% for most of the year.

California Markets Outlook:

Home sales projected to rise 10.5% in 2025.

Median home price expected to increase 4.6% to $909,400.

Affordability remains a challenge, with only 16% of households able to afford a median-priced home.

The California real estate market is currently experiencing a cooling trend characterized by a slight year-over-year median price decline, fewer homes sold, and increased inventory. While high mortgage rates continue to pose a challenge, a market crash is not expected, with forecasts predicting a rebound in sales and modest price increases for 2025 and 2026, partly due to low housing inventory and a potential return of buyers and sellers to the market.

Subscribers

Subscribers

Subscribe to News

Subscribe to News

Donate/Subscribe

Donate/Subscribe World News & Facts

World News & Facts

Politics and Justice

Politics and Justice

Technology Innovation

Technology Innovation

Top Featured Posts

Top Featured Posts